Index-based Investment and Intraday Stock Dynamics

Team Information

Team Members

Yiwen Shen, PhD Candidate, Decision, Risk & Operations, Graduate School of Business, Columbia University

Abstract

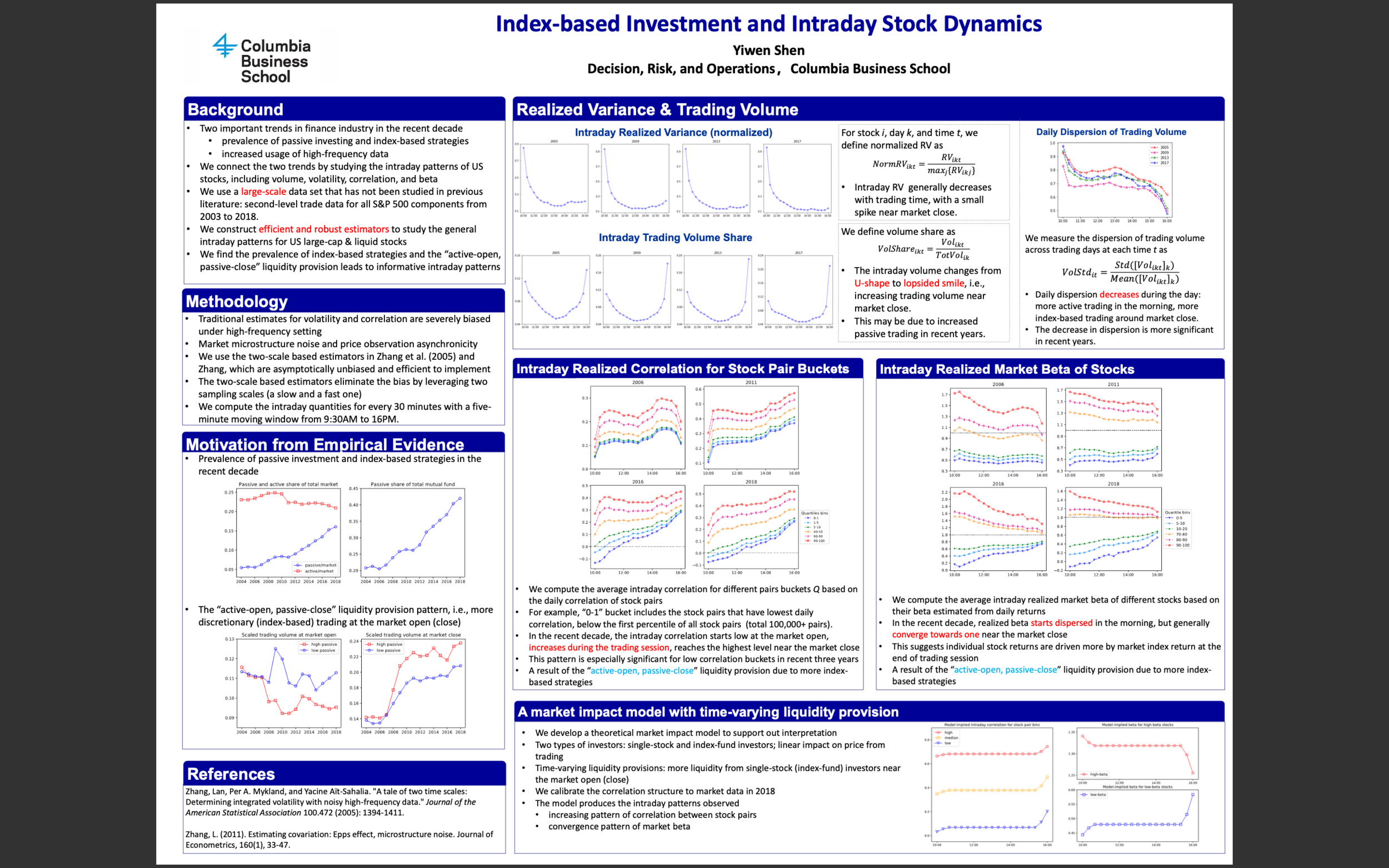

We investigate how the growth of index-based investing impacts the intraday stock dynamics using a large high-frequency dataset, which consists of 1-second level trade data for all S&P 500 constituents from 2004 to 2018. We estimate intraday trading volume, volatility, correlation, and beta using estimators that are statistically efficient under market microstructure noise and observation asynchronicity. We find the intraday patterns indeed change substantially over time. For example, in the recent decade, the trading volume and correlation significantly increase at the end of trading session; the betas of different stocks start dispersed in the morning, but generally move towards one during the day. Besides, the daily dispersion in trading volume is high at the market open and low near the market close. These intraday patterns demonstrate the implication of the growth of index-based strategies and the active-open, passive-close intraday trading profile. We theoretically support our interpretation via a market impact model with time-varying liquidity provision from both single-stock and index-fund investors

Contact this Team

Team Contact: Yiwen Shen (use form to send email)